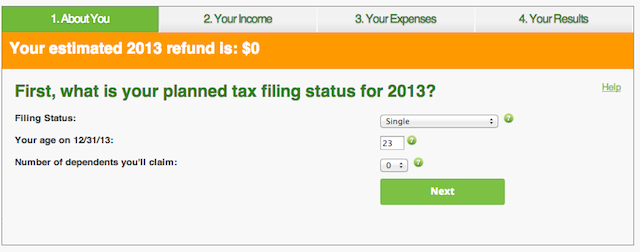

Users who wish to pay for their accounts via direct deposit can sign up for free with any major Canadian bank or credit union. Their most basic option costs $0 per month and allows users to access their own account 24/7 from any device via a secure login. If you’re filing online, simply enter your personal information (name, address etc.) along with details about income earned throughout the year.Ĭ) Provides you with the flexibility to choose how much money you want to save by using the tax saving feature within your tax calculator Ontario. Plus, they will prepare all of your taxes on time so there are no penalties or late fees! AdvantagesĪ) Allows you to plug in all necessary information such as income earned during the year, expenses related to earning said income, deductions available under your current employment status etc.ī) Gives you options to file online or print out a form and mail it in. It’s always wise to go with a brand you trust like - they have everything you need!

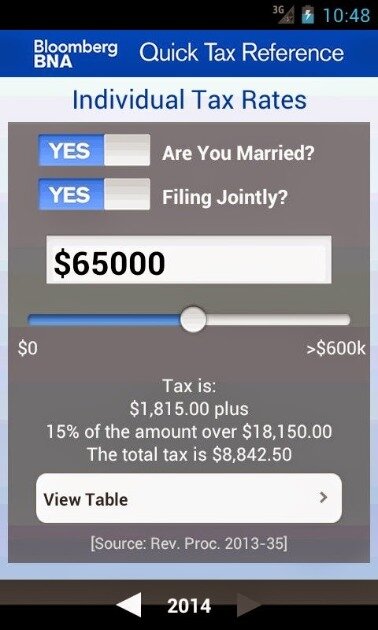

It will help you make sense of what would otherwise be a very complicated calculation. No matter if you’re self-employed or work for an employer, you should definitely familiarize yourself with the free federal tax calculator features. Luckily, there are many other tools out there for calculating your income taxes, maximum deductions and eligible credits, all of which should be used to better inform you when filing your taxes next year.

The CRA (Canada Revenue Agency) provides one tool-the tax calculator-but using it will only give you an estimate, not an exact amount that you can enter on your tax return. This will help to ensure that you’re getting the most deductions and credits possible from the Government.

Whether you’re doing your own taxes or paying someone else to do them, it’s always good to have the right tools on hand. 5 Essential Tools to calculate your income taxes The maximum influx of the tax calculation and payment to electronic platforms can make it more convenient for the public to manage their own tax filing. Within April 2022, almost 93.7% of the tax paying population have used electronic methods to file their taxes and claim their returns. With tax season in full swing, it’s important to make sure you are equipped with the tools to accurately calculate your taxes and save as much money as possible this year.

0 kommentar(er)

0 kommentar(er)